Last week, Christie’s sold a digital collage of images called “Everydays: The First 5000 Days” for US$69.3 million dollars. This week, Elon Musk said he’s selling a tweet of his as an NFT, which contains a song about NFTs.

The bidding on Musk’s tweet has already topped $1 million and millions more are pouring into the market — he has since tweeted, “Actually, doesn’t feel quite right selling this. Will pass.” And sites like NBA Top Shot (where you can buy, sell and trade digital NBA cards) have individual cards selling for over US$200,000.

It might sound ridiculous but the explosive market of crypto-collectibles and crypto-art is no joke. I investigate cryptocurrencies and have academic publications on Bitcoin markets. To help you understand what an NFT is and why they’re becoming so popular, here’s an explainer to make sense of it all.

What is an NFT?

A non-fungible token (NFT) is a digital file with verified identity and ownership. This verification is done using blockchain technology. Blockchain technology, simply put, is an un-hackable system based on the mathematics of cryptography. So, that’s why you hear a lot of “crypto” when referring to NFTs — crypto-art, crypto-collectibles, etc.

What is fungibility?

Fungibility is the ability of an asset to be interchanged with other individual assets of the same kind; it implies equal value between the assets. If you own a fungible asset you can readily interchange it for another of a similar kind. Fungible assets simplify the exchange and trade processes, and the best example would be (you guessed it) money.

Is NFT the same as Bitcoin?

This is where I can explain and emphasize the “non-fungibility” property of NFTs. The main difference between NFTs and Bitcoins is the fact that Bitcoins are limited, and fungible (you can trade one Bitcoin with another and both have the same value and price). NFTs are unique but unlimited, and non-fungible (no two artworks are the same). While NFTs can appreciate in value (just like real estate), they cannot be interchanged for another NFT.

What does this mean for the future of money?

While not directly related to NFTs, it’s important to mention some properties of money. Among many properties, money has to be fungible (one unit is viewed as interchangeable as another), and divisible (can be divided into smaller units of value). NFTs are not fungible nor (easily) divisible.

For example, a single dollar is easily convertible into four quarters or ten dimes, but currently you cannot divide one NFT (although the blockchain technology behind may allow it in future). In fact, fungibility and divisibility are part of five requirements for a currency to exist in a regulated economy.

Why are NFTs being valued?

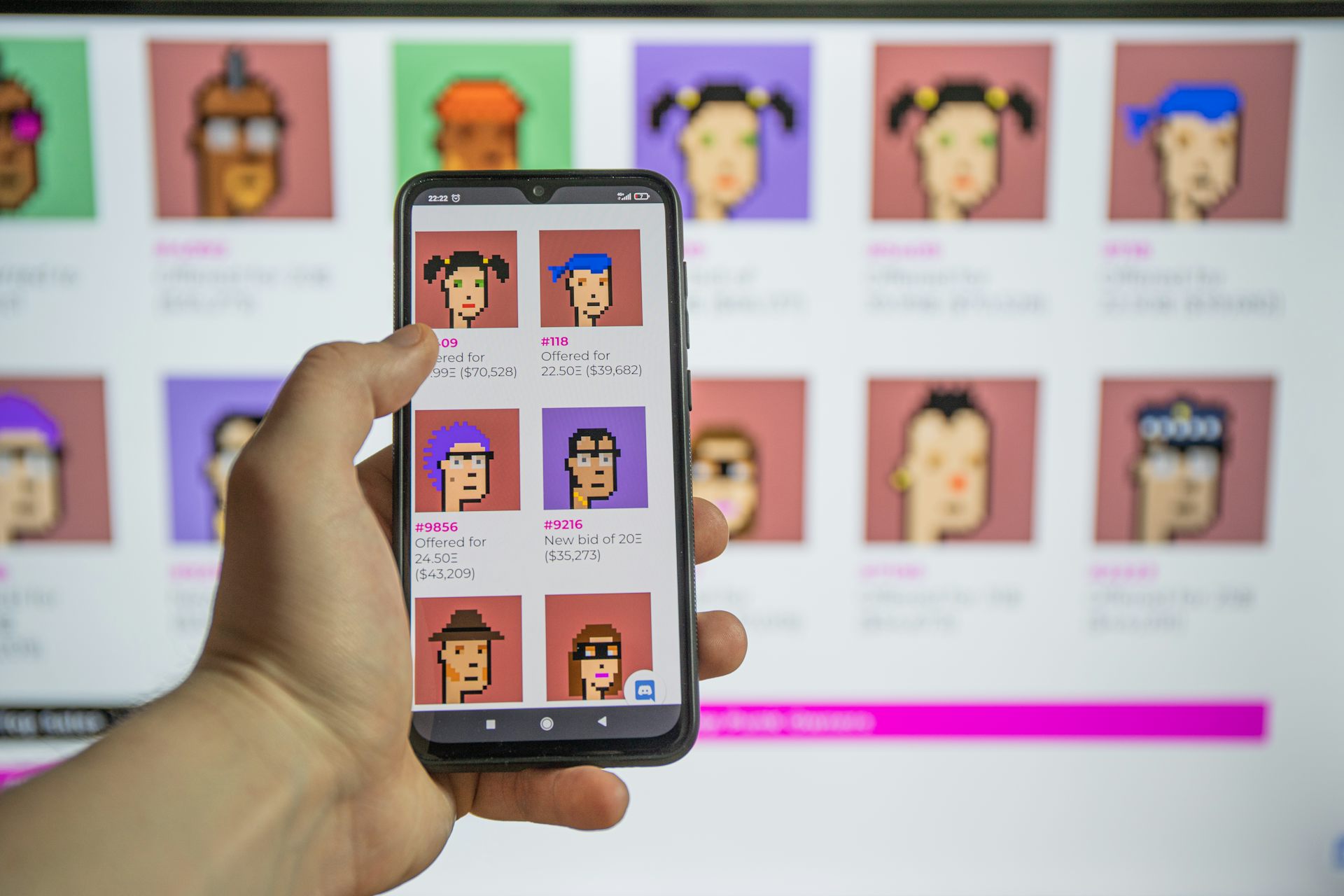

The importance of NFTs lies in providing the ability to securely value, purchase and exchange digital art using a digital ledger. NFTs started in online gaming, later with Nike’s patenting of its authenticity (CryptoKicks) and then by the famous Christie’s auction embracing NFT valuation of a digital art piece.

NFTs are commonly created by uploading files, such as digital artwork, to an auction market. Just like any other form of art, NFTs are not mutually interchangeable, making them more like “collectible” items.

The platform (typically Ethereum) allows the digital art to be “tokenized” and for the ownership to be safely stored using a decentralized, open-source blockchain (that is, anyone can check the ledger), featuring smart contract functionality. This means the traditional role of a “middle man” for selling the art is now digitized.

Is owning the NFTs the same as owning the copyright?

No, owning the NFT doesn’t grant you the copyright to the art; they are distinct from one another. The ownership of the NFT is established using a digital ledger, which anyone can access because it is stored openly. This ledger tracks who owns an NFT and ensures that the NFT can’t be duplicated or tampered with, essentially a “smart contract.”

What does the future hold for NFTs?

It is undeniable that digital assets and blockchain technology are changing the future of trade. As a result, NFTs are also at the helm of this positive growth. However, just like other examples in history (e.g. the Dutch Tulip, the dotcom bubble, etc.), certain valuations may see the need for future corrections depending on socio-economic desires and the chance of a bubble.

Every generation has its own niche attachment to certain valuations whether for vanity or other reasons. NFTs are currently very popular among younger generations, but whether this generation will have the economic power to purchase or find use for them in the future, is both a social and economic question.

For NFTs the true potential is yet to be uncovered. Whether big industry players in art, design or fashion will buy into it or not is also yet to be seen. One thing is for sure, NFTs did open the door for many digital artists to be identified and valued, and the smart contract functionalities of the blockchain technology will be used in future valuations of many assets.

Written by Laleh Samarbakhsh, Associate Professor, Finance, Ryerson University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

![]()